Interview Stanford Feifei Silicon Valley Financialtimes

In a compelling dialogue, Stanford’s Fei-Fei Li offered insights into the intersection of artificial intelligence and the financial sector in Silicon Valley. Her reflections on AI’s capacity to enhance decision-making processes and improve risk assessment are particularly timely, given the rapid evolution of financial technologies. However, she also raised critical concerns regarding the ethical implications and regulatory challenges that accompany such advancements. As the conversation unfolds, the implications of her viewpoints on the future of finance and trust in AI systems merit deeper exploration.

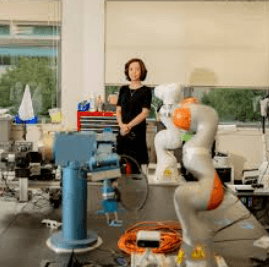

Fei-Fei Li’s Background and Expertise

Fei-Fei Li’s profound impact on the fields of artificial intelligence and computer vision stems from her extensive background and expertise, underscored by a commitment to advancing technology for societal benefit.

Her academic contributions, including the development of ImageNet, have significantly influenced deep learning and computer vision research.

Li’s work not only enhances technological capabilities but also emphasizes the ethical considerations surrounding AI applications for a free society.

See also: Interview Stanford Feifei Silicon Valley Aihammond

AI Transforming Financial Technology

Artificial intelligence is increasingly transforming the landscape of financial technology, driving innovation and efficiency across various sectors.

AI applications enhance decision-making processes, enabling firms to analyze vast datasets swiftly. In algorithmic trading, AI algorithms execute trades with precision, optimizing performance and reducing human error.

This integration not only streamlines operations but also empowers investors, fostering a more dynamic and responsive financial ecosystem.

Future Challenges in Finance

Significant challenges loom on the horizon for the finance sector as it grapples with rapid technological advancements and shifting regulatory landscapes.

Companies must navigate increasing regulatory changes while addressing the implications of market volatility.

Adapting to these dynamics requires innovative solutions and agile strategies.

Embracing transparency and fostering resilience will be crucial in maintaining stability and trust in an ever-evolving financial environment.

Conclusion

In conclusion, the integration of artificial intelligence into Silicon Valley’s financial sector represents not merely an evolution but a revolution in decision-making and operational efficiency. As AI continues to reshape risk assessment and personalized services, the imperative for ethical considerations becomes increasingly evident. Without a steadfast commitment to trust and resilience, the promise of AI may falter, leaving the financial landscape vulnerable to the very complexities it seeks to address. Thus, vigilance in ethical application is paramount.