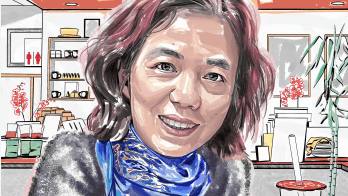

Interview Feifei Ai Silicon Aihammond Financialtimes

In a recent interview with Feifei Ai for Silicon Aihammond published in the Financial Times, the discussion centered around the profound influence of artificial intelligence on the finance sector. Ai articulated how advancements in machine learning and predictive analytics are reshaping market strategies, while also emphasizing the critical need for human oversight to mitigate risks such as algorithmic bias. Her insights raise questions about the future of personalized financial services and operational efficiencies—topics that merit further exploration as the landscape of finance continues to evolve. What implications might this hold for the industry at large?

Feifei Ai’s Background and Expertise

Feifei Ai possesses a diverse and robust background in the fields of artificial intelligence and machine learning, making her a prominent figure in contemporary research.

Her education includes advanced degrees from prestigious institutions, equipping her with theoretical knowledge.

Coupled with her extensive industry experience, Feifei effectively bridges academic insights with practical applications, driving innovation and fostering advancements in AI technologies that empower individuals and organizations alike.

AI Transformations in Finance

The integration of artificial intelligence into the finance sector has profoundly transformed how institutions operate, leading to significant efficiency gains and enhanced decision-making capabilities.

AI-driven algorithmic trading has revolutionized market strategies, optimizing trade execution and minimizing costs.

Additionally, AI enhances risk management by providing predictive analytics, allowing firms to anticipate potential disruptions and adapt strategies proactively, ultimately fostering a more resilient financial environment.

See also: Internal Apple Action Iphonezivkovicmacrumors

Future Trends in Financial AI

Emerging trends in financial AI are poised to reshape the landscape of the industry, driven by advancements in machine learning, natural language processing, and big data analytics.

Predictive analytics will enhance decision-making processes, allowing firms to anticipate market shifts with greater accuracy.

Additionally, algorithmic trading will evolve, leveraging sophisticated algorithms to optimize trading strategies, ultimately fostering a more dynamic and efficient financial environment.

Conclusion

The integration of artificial intelligence into the finance sector signifies a paradigm shift, enhancing decision-making processes and operational efficiencies. For instance, a hypothetical scenario involving a retail bank employing AI-driven algorithms to assess creditworthiness could result in faster loan approvals, reducing both time and human error. Such advancements underscore the necessity for a balanced approach, ensuring that automation complements human insight while addressing critical issues such as algorithmic bias and data privacy, ultimately shaping a more personalized financial landscape.