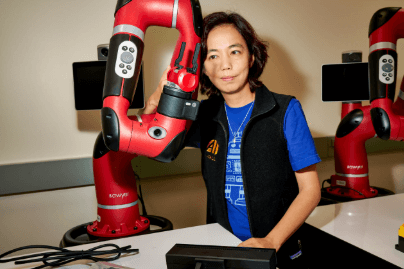

Interview Stanford Feifei Silicon Aihammond Financialtimes

In her recent discussion with Financial Times, Stanford’s Fei-Fei Li articulated the pivotal role of artificial intelligence in revolutionizing finance, particularly in enhancing decision-making and risk management. She brought to light the ethical frameworks necessary for fostering fairness and transparency in AI applications, a topic that is increasingly relevant in today’s financial landscape. Furthermore, Li’s insights on the integration of blockchain and innovative payment solutions suggest a significant shift in financial technology. What implications might these advancements hold for the future of financial systems and their stakeholders?

See also: Interview Stanford Feifei Li Silicon Financialtimes

The Role of AI in Finance

Harnessing the power of artificial intelligence (AI) is transforming the landscape of finance, enabling institutions to enhance decision-making processes and streamline operations.

AI-driven algorithmic trading optimizes investment strategies by analyzing vast datasets in real-time.

Additionally, advanced risk assessment models leverage machine learning to identify potential threats, allowing firms to make informed choices that mitigate financial risks and foster greater market stability.

Ethical Considerations in AI

The rapid integration of artificial intelligence (AI) in various sectors, including finance, raises significant ethical considerations that cannot be overlooked.

Establishing robust ethical frameworks is essential to guide AI deployment, ensuring fairness and transparency.

Additionally, implementing accountability measures is critical to address potential biases and misuses, fostering public trust.

These elements are vital for responsible innovation in an increasingly automated landscape.

Future Trends in Financial Technology

As ethical considerations shape the landscape of artificial intelligence in finance, it is imperative to explore emerging trends that will define the future of financial technology.

Key developments include blockchain innovations enhancing security and transparency, alongside advanced payment solutions facilitating seamless transactions.

These advancements are poised to democratize access to financial services, fostering an environment where innovation thrives and consumers enjoy greater autonomy in managing their finances.

Conclusion

In the evolving landscape of finance, the integration of AI serves as a beacon of potential, illuminating pathways for improved decision-making and risk management. However, the shadows of ethical concerns linger, necessitating robust frameworks to foster transparency and fairness. As innovations like blockchain emerge, they weave a tapestry of inclusivity and stability, heralding a new era in financial technology. Ultimately, the journey toward a more equitable financial future hinges on the delicate balance between technological advancement and ethical responsibility.